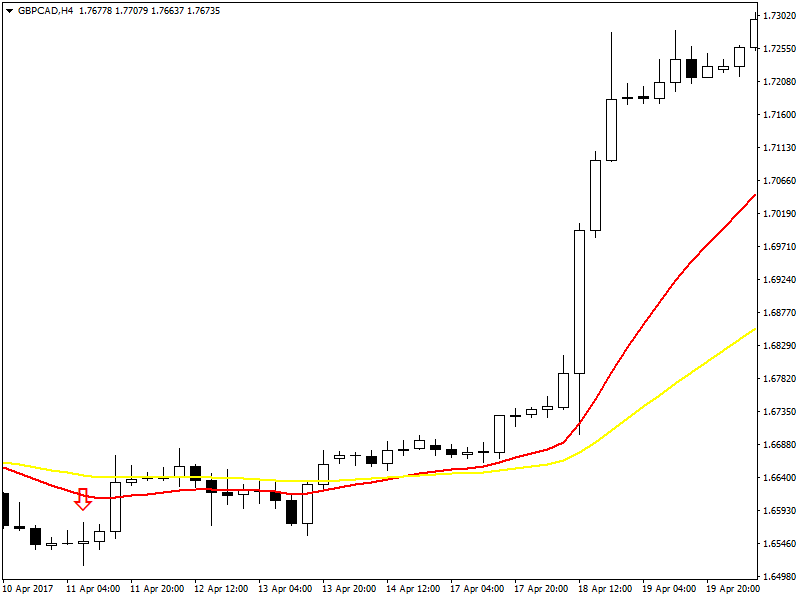

GBPCAD is a pair that often gets little attention by currency traders. If you have been reading my Day Trader Blog then you must be aware that I look for trades that catch the big moves in the market with a small stop loss. I use H4 chart for entry and exit while I look at the daily and the weekly for getting the broader view on where the market is going. Take a look at the following GBPCAD H4 chart.

Can you see the red arrow? This is the candle that is giving a signal for a market change. Always keep this in mind. Currency market changes direction suddenly. The change first appears on the lower timeframes then it propagates to a higher timeframe. So we cannot wait for the change to become clear on the daily chart as by then market would have made half of the move. We have to catch the move early. H4 chart is the best chart for catching a big move with a small stop loss. This bullish pinbar is a signal that market is changing. So I placed a pending buy limit order with entry price 1.65400 with stop loss at 1.65100. So the risk is 30 pips. Did you watch this documentary on hedge fund trading strategies?

This is important for you to know that I don’t look at H1, M30 or M15 charts. Candlestick patterns on H1, M30 and M15 are highly unreliable and can mislead you a lot. This is what I have learned from experience. 1 hour candle encompasses 1 hour of price action while a 4 hour candle encompasses 4 hours of price action. So you can well imagine, H4 candle is much more solid as compared to a H1 candle. In the same manner a daily candle is much more solid as compared to a H4 candle. The high/low made by a daily candle are important support/resistance levels. So does the high/low of a weekly candle. They are also important support/resistance areas. Watch this interview on Maribeth’s favorite day trading setups.

Now when you are trading minor pairs like GBPCAD, keep this in mind that 1 pip has a different value as compared to that for EURUSD or GBPUSD. If you trade GBPUSD or EURUSD with one standard lot, 30 pips means $300. But here when we are trading GBPCAD, 1 pip is approximately equal to $7.32. So a stop loss of 30 pips means around $219. So instead of $300, we have a risk of $219 which is around 30% lower than trading EURUSD or GBPUSD. Did you take a look at our Million Dollar Trading Challenge?

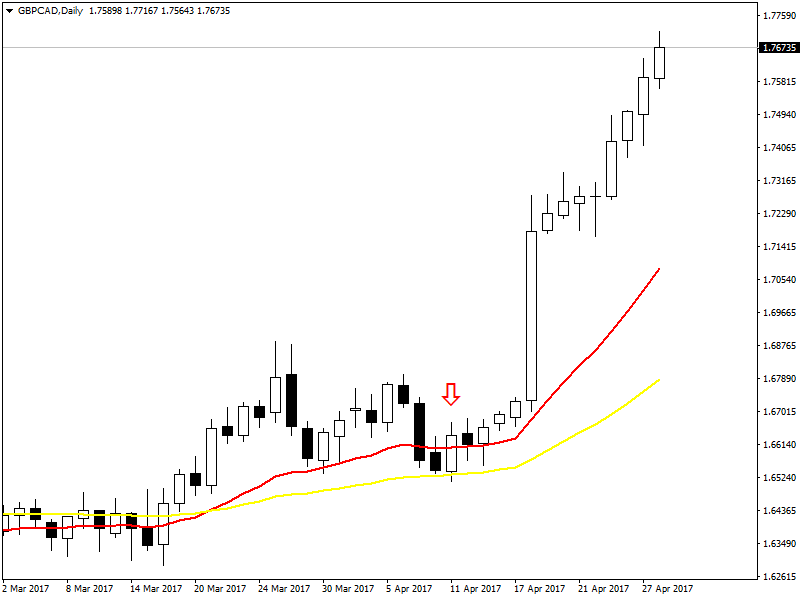

Above is the daily chart. You can see that GBPCAD is already in an uptrend. The bullish pinbar that appeared on H4 was close to the yellow line on daily which is the EMA 50. EMA 50 is generally used by most of professional traders for determining the trend in the market. If price is above EMA 50, it is considered bullish and if price is below EMA 50, it is considered bearish. So I made the entry. after that there is only 2 possibilities either the stop loss will get hit or the take profit target will get hit. In this case the take profit target has been fixed at 1000 pips or 1.75400. Take profit target was hit after around 12 days. So you have to be patient when it comes to swing trading. Did you read the post on the Million Dollar Trading Challenge Trading Plan?

Now this is what I do. When a trade goes positive, I move the stop loss to breakeven. After that the trade is risk free. I look for new opportunities. That trade can continue. As said above either the stop loss will get hit. In this case since I have moved the stop loss to breakeven, it means I lose nothing. This way you can open multiple trades while keeping the risk to your account below 2%. Now making 1000 pips on GBPCAD with a standard lot translates into $7320. Not bad for a months salary huh! Trading binary options along with forex is a good idea. Instead of scalping, I trade binary options. Technical analysis is the same. Did you take a look at my Million Dollar Trading Challenge II?

Always make sure you keep on withdrawing money from your broker. You never know when your broker declares bankruptcy. I had traded with the Gallant Capital Markets for sometime. Recently they declared bankruptcy. So don’t leave the money with the broker, keep on withdrawing money from your broker This way you are safe from a sudden shock when you see the broker website announcing bankruptcy. As said above I don’t trade forex on the lower timeframes. However I use 1 minute and 5 minute timeframe for trading binary options. Did you read this post on how to make your million dollar trading plan with binary options?

Another thing that you should keep in mind is that different brokers have different prices. For example in our example the entry was 1.65400 with stop loss at 1.65100. 1.651400 was the low made by this candle. So I placed the stop loss 4 pips below that low price. But with a different broker, the low price could have been 1.65090. In that case the stop loss should be placed at 1.65050. So using a traditional trade copier ea may not be a feasible idea. But I have solved this problem. Take a look at my Million Dollar Trading Challenge EA.

Trading can only be a great game if you have a proven and tested trading system. If you don’t have a proven and tested trading system, you will just win a few trades than lose a few trades and always stay where you are. So first focus on developing your trading system. Take some months. Don’t rush. Currency market is not going anywhere. Make sure you have a trading system with a winrate that is 80% on average. Test your trading system thoroughly. Once you are satisfied with the performance, you should then start trading live. Before that just focus on your trading system. Watch this documentary on the daily life of a professional currency trader.

Risk management is the most important thing in trading. There is no way you can predict the market 100%. Sometimes the trade setup simply fails. You have no idea when it is going to fail. What we want is the trade setup to work more than 80% of the time. We take account of this thing by keeping the risk low. I prefer to enter into a trade with a small stop loss of 10-20 pips. Most of the time I trade major pairs like EURUSD,, GBPUSD, USDCAD, NZDUSD, AUDUSD etc. As said in the start of this post, I use H4 candles for entry and exit. When you lose an entry, don’t worry you can enter on the next H4 candle or the next. Don’t try to trade near the turning points. You cannot determine the turning points. When the market changes direction and you think pretty sure about it only then open a trade. Watch this documentary on the risk of London millionaire forex traders.

Economic news as well breaking news is a major mover of the currency market. Election results can play havoc with your trades. Referendums, speeches by presidents and prime ministers are also dangerous times for currency traders. So you should take them into account when trading.