Prelim UoM Consumer Sentiment economic news is released on 15th of each month. Most of the time you will find the market show a knee jerk reaction when this data is released. UoM stands for University of Michigan. This is a telephone survey comprising 500 consumers who are asked questions regarding their expectations about the economy and their own financial and economic future as they perceive it. There are 2 versions of this survey. The Prelim and the Revised. As said above Prelim is released on 15th of each month and the revised survey on the 1st of the next month. This survey is released through a number of website. You can view the survey on the UoM website.

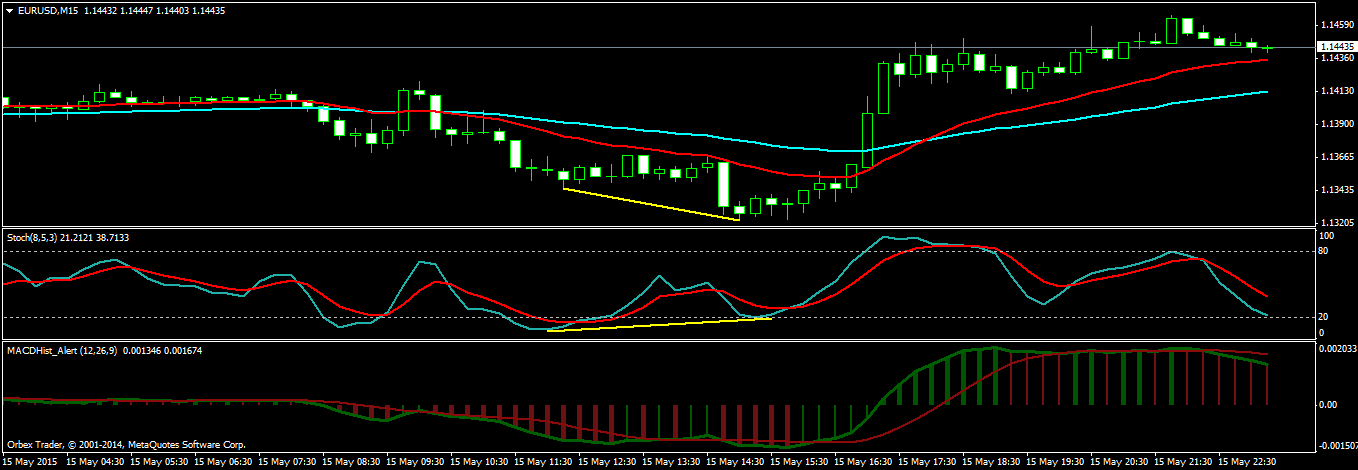

Now let’s come to our objective. How to trade Prelim UoM Consumer Sentiment? As said above Prelim causes more knee jerk reaction as compared to Revised. Now we are not concerned whether the survey is bullish or bearish or what are its implications for the economy. What we want is to look for a divergence pattern on the M15 chart just 30-60 minutes back on the EURUSD and GBPUSD charts and trade in that direction accordingly. Now keep this in mind that knee jerk reaction wears off pretty soon. So you should make 100-150 pips and then close it. Don’t expect the market to start a new trend in the direction that you had traded. Rather expect the market to start moving in the opposite direction when the knee jerk reaction is over. Take a look at the following chart.

Do you see this bullish divergence pattern on EURUSD M15 chart? Just open a buy trade and after a six hours close the trade for a profit of 120 pips. Now keep this mind both EURUSD and GBPUSD are correlated. When EURUSD moves up on USD economic data release expect GBPUSD to move in the same direction.

As you can see GBPUSD is also moving up but it fell down more. If you are a new trader, just make sure you close the trade after a few hours. As most of the news causes only a knee jerk reaction in the market and then the market starts moving the direction that it had been moving previously.