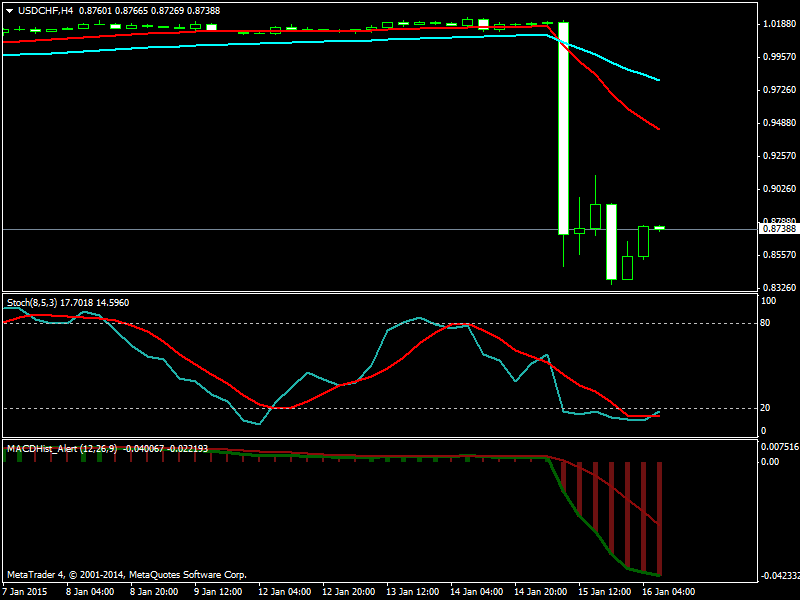

Central banks are the most important players when it comes to moving the currency market. This is precisely what the Swiss National Bank (SNB) did yesterday when it totally surprised the market by announcing removal of swiss franc euro peg. In the past SNB had been worried about CHF appreciating too much and hurting Switzerland’s exports. So it made the decision to peg 1.20 swiss francs to 1 euro some 3 years back. CHF is considered to be a safe haven currency alongwith gold. USDCHF fell massively as CHF appreciated around 41%. USDCHF fell 1867 pips in just 1 day making history in the currency markets for the biggest fall in one day.

The Swiss National Bank said it was removing a cap of 1.2 Swiss francs to the euro, introduced during the eurozone crisis in 2011 when a flood of cash sought refuge in the traditional safe haven.

Switzerland was worried that a rapid appreciation in its currency would slam exporters and cause deflation in its economy.

Basically Swiss National Bank is worried about the Quantitative Easing program being introduced by the European Central Bank next week that will flood the market with cheap euros. It would become practically very difficult for the SNB to defend the peg that it has introduced some 3 years back as said above. So it decided to do away with the peg while at the same time it cut the interest down in an attempt to stop CHF appreciating too much. Some people are calling this sudden decision by the Swiss National Bank as amateurish.

It wasn’t just the euro that got caught up in the franc’s frenzied moves. The dollar initially plunged by a similar amount, though it also recouped some of its kneejerk losses to trade 15 percent lower at 0.8884 francs.

Despite the backlash, the SNB will face from those who are nursing potential losses that could run into billions, many analysts thought the decision was inevitable in light of next week’s expected announcement by the ECB to break new ground in its efforts to inject life into the ailing 19-country eurozone economy. Its stimulus package is expected to be worth as much as 1 trillion euros ($1.17 trillion).